HomeBlog 5 Vital Insights about Marriage Allowance

5 Vital Insights about Marriage Allowance

Kausik MukherjeeMarriage Allowance

Are you aware of this fact that the UK tax regulations authority (HMRC) offer marriage allowances to partners or spouse? This is one of those additional tax perks that makes it easier for a partner or spouse in UK to reduce their tax burden. So, let’s take a look at how this works?

1 Understanding Marriage Allowance

The term Marriage Allowance is a term that allows a couple to reduce their tax liability by £1,250. The arrangement takes place when a lower income individual transfers his/her unused personal allowance to the partner whose current income is taxable as per the prevailing tax provisions. This results in additional tax savings.

2 Understanding the computation

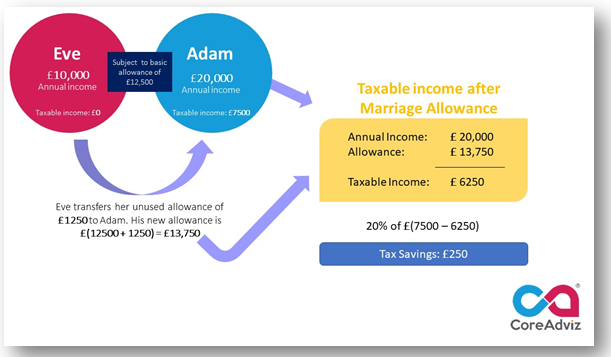

When it comes to computation, let’s take an example. Suppose Adam and Eve are a couple where both have their monthly income. Adam earns about £20,000 whereas Eve earns about £10,000 every year. Now Eve’s total income is below £12,500, hence her income is not taxable. However, Adam’s annual income is £20,000 and his taxable income under current rule would be £(20,000 – 12,500) = £7,500. In order to avail marriage allowance, Eve can transfer £1,250 in unused personal allowance to Adam. This increases the personal allowance for Adam to £13,750, i.e, £(12,500 + 1250).

The above-mentioned arrangement now reduces the tax liability to £6,250 for Adam.

3 Eligibility Criteria for Availing Marriage Allowance

•The person should be either married or be in a civil partnership

•One partner’s salary should be below personal allowance bracket, whereas the other partner’s salary should be within the basic income tax rate bracket.

•Both the partners should be born after 5th April 1935

4 Can Marriage Allowance be claimed in retrospect?

Yes! The provisions of the existing tax regulation allow a couple to avail marriage allowance in backdate upto 4 years. This means that if any of the partner died after April 2016, the other partner can still claim this allowance. HRMC has also setup a helpline number in order to entertain such issues.

5 Cancellation of marriage allowance

Marriage allowance automatically gets cancelled when marriage ends by:

•Divorce

•Death of a partner

Alternatively, people can also cancel their marriage allowance manually by connecting with HMRC at 0300 200 3300. Interested in knowing more? Get in touch for a cup of coffee! Dial: +44 3301331114